The Role of Oils in Beauty Routines

Let’s take a look at what our Beauty Buddies have to say on the subject.

In recent years, the beauty industry has seen a significant shift toward incorporating oils into skincare and haircare routines. Oils, once considered heavy and greasy, are now hailed as multitasking heroes that provide nourishment, hydration, and protection. This blog delves into consumer insights on the use of oils in their beauty routines, highlighting preferences, habits, and the factors influencing their choices.

The Rising Popularity of Oils

Oils have gained traction as consumers increasingly seek natural and effective solutions for their beauty needs. Factors contributing to this trend include:

Increased Awareness of Ingredients: Today's consumers are more ingredient-savvy, seeking products that offer both efficacy and safety. Natural oils, derived from plants, have become desirable for their perceived purity and potency.

Versatility: Oils can serve multiple purposes—hydrating skin, nourishing hair, and even enhancing makeup. This versatility appeals to consumers looking to simplify their routines without compromising results.

Holistic Wellness Trends: The rise of wellness culture has led consumers to seek products that align with their holistic health goals. Oils, often associated with aromatherapy and wellness, fit seamlessly into this narrative.

Today’s consumers are increasingly drawn to natural ingredients and sustainable practices. Oils derived from plants and botanicals not only align with these preferences but also promote a sense of wellness. Brands should consider highlighting the sourcing and sustainability of their oil ingredients to resonate with eco-conscious consumers.

Also, beauty enthusiasts are on the lookout for products that serve multiple purposes. Oils are versatile; they can moisturise, treat specific skin concerns, and even enhance makeup application. Brands that market their oils as multi-functional products can attract consumers seeking streamlined routines without sacrificing efficacy.

Brands must prioritise consumer education and transparency regarding their oil formulations. Providing detailed information about ingredient sourcing, benefits, and application techniques can empower consumers to make informed choices. Additionally, brands can leverage social media and influencer partnerships to showcase real-life applications and testimonials, fostering trust and engagement within their target audience.

Listening to the Consumer

To successfully navigate the oil market, brands should prioritise collecting feedback from consumers. Surveys and market research can provide invaluable insights into preferences, usage habits, and pain points. By actively listening and adapting to consumer feedback, brands can refine their product offerings and marketing strategies to better align with consumer expectations.

Our recent survey on the use of oils in beauty routines provides valuable insights into how consumers are integrating these products into their skincare. The findings shed light on the most popular oils, key benefits sought by users, and how preferences vary across different beauty needs. By understanding these trends, beauty brands can better tailor their offerings to meet evolving consumer expectations and capitalize on the growing demand for oil-based products. Let’s dive into the results and explore what consumers are looking for in their oil-infused beauty routines.

96% of respondents reported having used oils in their beauty routine at some point.

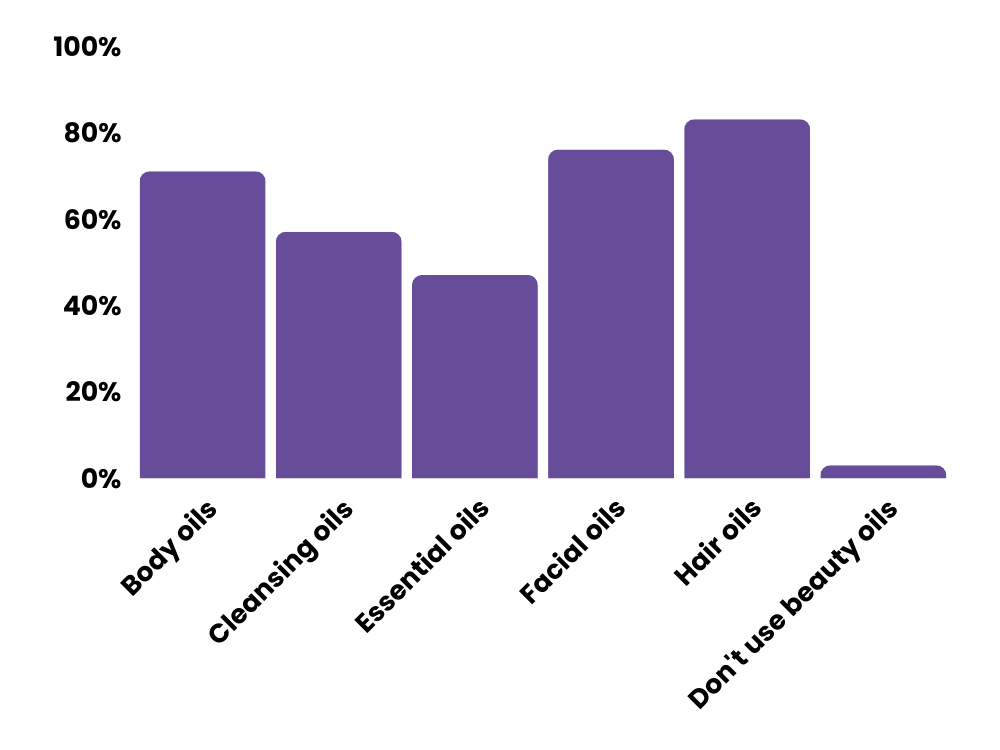

Type of oils used

When we asked respondents about the types of oils they incorporate into their beauty routines, 83% reported using hair oils, making them the most popular choice.

76% use facial oils, and 71% include body oils in their regimen. Cleansing oils are also a common choice, used by 57% of respondents, while 47% opt for essential oils for aromatherapy.

Notably, only 3% said they don't use beauty oils at all.

Frequency of usage

Regarding the question of how often respondents use oils in their beauty routine, 47% indicated they use them a few times a week, while 37% use them daily.

Furthermore, 10% reported using oils occasionally, and 3% stated they use them rarely or never.

Knowledge

In our assessment of respondents' knowledge about different types of beauty oils, 47% indicated they are somewhat knowledgeable, while 20% consider themselves very knowledgeable.

Additionally, 25% reported knowing a little, 6% are just getting started, and 2% have no knowledge at all.

Reasons of oils usage

In our survey regarding the reasons for using or considering beauty oils, 81% of respondents identified moisturisation and hair repair as their top priorities.

Additionally, 73% use oils for skin repair (including scars and acne), while 66% are motivated by anti-aging benefits.

Furthermore, 62% appreciate oils for relaxation and aromatherapy, and 58% use them for makeup removal.

Formulation Preferences

When asked about their preferred type of oil formulation for beauty products, 27% of respondents favoured lightweight oils, while 25% preferred oils mixed with other ingredients (such as serums or creams).

Additionally, 23% opted for oil blends (multiple oils mixed together), and 13% preferred pure oils (single ingredient).

Only 1% chose rich, thick oils, and 10% remained unsure about their preference.

Is texture important?

Regarding the importance of oil texture in users' decisions, 35% of respondents indicated that it is important (preferring oils that absorb quickly), while 32% said it is very important (only using lightweight, non-greasy oils).

Additionally, 29% felt neutral, stating they are okay with any texture as long as the oil works effectively.

Only 1% considered texture less important (not minding heavier oils), and 3% stated it is not important at all.

Concerns

When asked about their concerns regarding the use of oils in their beauty routine, 50% of respondents expressed worries about greasiness, while 40% were concerned about clogging pores.

Additionally, 49% mentioned the difficulty of finding the right oil for their skin type, and 33% were apprehensive about causing breakouts.

10% cited cost as a concern, while 11% stated they have no concerns at all.

Packaging

In our survey regarding packaging preferences for beauty oils, 43% of respondents expressed no preference.

Following this, 36% favoured glass dropper bottles, while 13% preferred pump dispensers.

Additionally, 4% liked roller balls, 3% chose spray bottles, and only 1% preferred tubes.

Incorporation of Oils in Beauty Routines

When asked how respondents typically incorporate oils into their routines, 80% reported using them as a hair treatment or serum, while 66% use them as a body oil.

Additionally, 64% incorporate oils as a moisturiser, and 58% use them for massage or relaxation.

Furthermore, 56% mix oils with other products, such as serum or foundation, and 52% use oils as a makeup remover.

Favourite oil ingredients

In our survey on favourite oil ingredients, 78% of respondents selected argan oil, while 72% preferred almond oil.

Additionally, 69% chose coconut oil, 68% favoured jojoba oil, and 62% liked rosehip oil. 53% of respondents indicated a preference for tea tree oil, and 49% opted for grapeseed oil.

Furthermore, 50% selected marula oil, 50% preferred olive oil, and 50% indicated squalene

Only 7% of respondents reported that they did not prefer any of these oil ingredients.

Are you keen to gather valuable feedback and insights directly from your target audience? Don't hesitate to reach out to us today to discuss the exciting possibilities of running targeted surveys. Let us help you achieve your goals!

We understand the importance of knowing your target audience. Do you make assumptions about your consumers, their preferences, opinions and needs? Understanding your consumers is key to ensuring your business decisions are well-informed and effective.

AT PXBB we run targeted survey campaigns, through Beauty Buddy the app, for our clients. Surveys provide answers, generate fresh data and insights, they substantiate assumptions and also help identify new trends.